Dismiss for Failure to File Taxes under Section 521(j)

Last Updated: November 22, 2013

Created: November 22, 2013

Background:

Click to view General Dismissal Information

This event should be used by a taxing authority to file a Motion to Dismiss for Failure to File Taxes under Section 521 (j)1.

Step by Step Procedures:

-

Select [ Bankruptcy > Motions/ Applications ]

-

Enter case number and click Next

-

Select Dismiss for Failure to File Taxes under Section 521(j)(1)

-

Click Next

-

Select the Party you represent from the party pick list or Add Create a New Party if your party does not appear in the pick list

-

Click Next

-

The Attorney/Party Association screen may display

- Click Here for more information

-

Click Next

-

The PDF screen will display :

-

Click Next

-

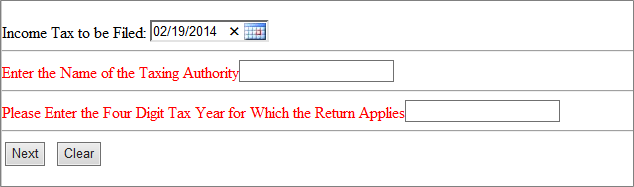

The tax recording screen will display.

-

Type the name of the Taxing Authority

-

Enter the Four Digit Tax Year for which the return applies

-

Click Next

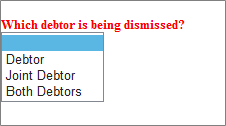

If the case is a joint case, click here

click here

A prompt will display :

-

Select the debtor being dismissed

-

Click Next

-

-

On the Hearing Screen

-

Insert Hearing Date, Time, and Location

-

Click Next

-

-

The Modify Text Screen will display. If applicable, you may make a selection from the prefix dropdown box.

Note: Please be sure any prefix is also on your PDF.

-

The

Final Text screen will display.

Final Text screen will display.

Basic Example:

Notice of Motion and Motion to Dismiss for Failure to Timely File Tax Return under Section 521(j)(1) for Debtor. Taxing Authority: (Name of Taxing Authority) Tax Year (Four Digit Year) Filed by Attorney Testing on behalf of (party). Income Tax Return Due by 02/19/2014.Hearing scheduled for 11/26/2013 at 10:00 AM at 219 South Dearborn, Courtroom 719, Chicago, Illinois 60604. (Attachments: # (1) Proposed Order) (Testing, Attorney)

This is your final opportunity to modify the entry before submitting the filing.

-

Verify the accuracy of the docket text

-

Click Next to complete the filing process

-

The Notice of Electronic Filling will display. It serves as verification that the filing has been sent electronically to the court.

Copies of this notice and the document filed are emailed to all participants who receive electronic notification in the case. You have a period of 15 days for a one time free look at the documents.